HANOVER, Germany — Continental ended the second quarter (Q2) of 2023 with strong earnings again in the tires group sector and high order intake in automotive of around €8.6 billion. The ContiTech group sector achieved solid results, while earnings in Automotive fell short of expectations, mainly due to currency effects and continuing costs for special freight.

Furthermore, inflation-related price negotiations scheduled for the second quarter are still ongoing.

As a result of updated market expectations in the tire-replacement business, Continental has adjusted its outlook for sales in the tires group sector and for consolidated sales. The outlook for the adjusted EBIT margins remains unchanged. The technology company therefore expects consolidated earnings to increase in the second half of the year.

Related post:

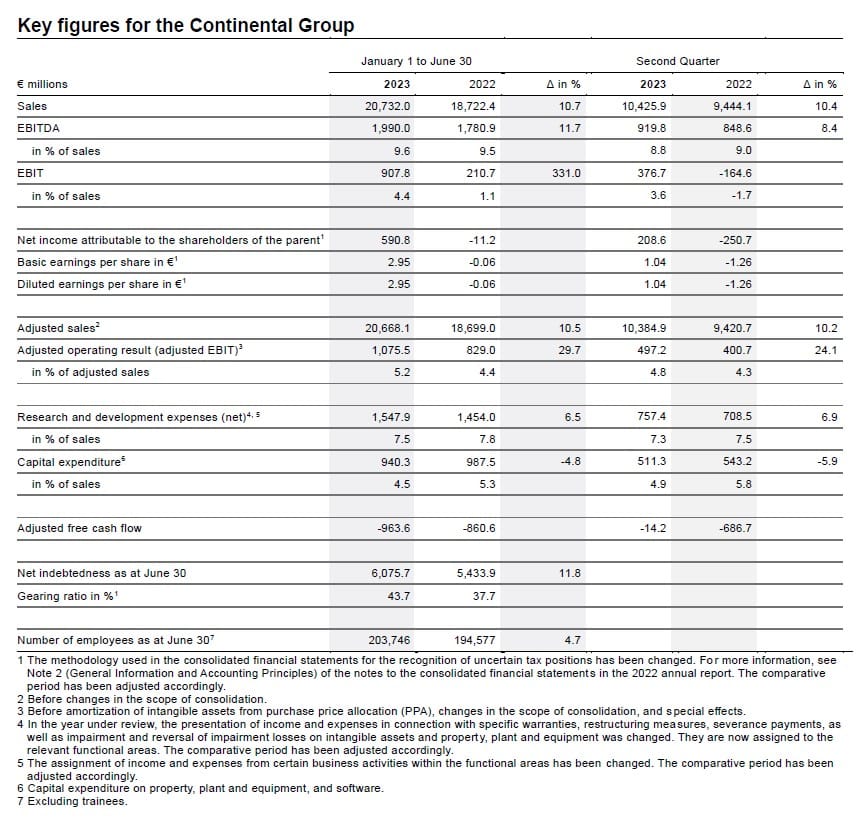

Continental Preliminary 2nd Quarter Results:

In the second quarter of 2023, Continental achieved consolidated sales of €10.4 billion (Q2 2022: €9.4 billion, +10.4 percent). Its adjusted operating result (adjusted EBIT) was €497 million (Q2 2022: €401 million, +24.1 percent), corresponding to an adjusted EBIT margin of 4.8 percent (Q2 2022: 4.3 percent).

Net income in the second quarter amounted to €209 million (Q2 2022: -€251 million). Adjusted free cash flow was -€14 million (Q2 2022: -€687 million).

“Despite difficult market conditions, our tires group sector ended the second quarter with good earnings once again. ContiTech’s performance remained solid. Earnings in automotive, however, fell short of expectations. Here we will need to make up considerable ground in the second half of the year. By doing so, we will also improve our consolidated margin,” said Continental CEO Nikolai Setzer in Hanover on Wednesday. “Through our partnership with Aurora, we have generated significant order intake and taken a major technological step forward in autonomous mobility. Together, we will bring the first commercially scalable autonomous trucking system to the US market.”

Adjustment of market outlook and forecast for fiscal 2023

For the current fiscal year, Continental expects the production of passenger cars and light commercial vehicles to increase by 3 to 5 percent year-on-year (previously: 2 to 4 percent). For the global tire-replacement business, the technology company expects sales volumes to develop by

-2 to 0 percent (previously: 1 to 3 percent).

Continental has adjusted its outlook for the current fiscal year due to the declining European and North American markets in the tire-replacement business. Continental now expects sales in the tires group sector of around €14.0 billion to €15.0 billion (previously: €14.5 billion to €15.5 billion) and consolidated sales of around €41.5 billion to €44.5 billion (previously: €42 billion to €45 billion). The outlook for the company’s other sales and margin expectations remains unchanged.

Continental also continues to expect significantly higher costs for materials, wages and salaries as well as energy and logistics in fiscal 2023. These are expected to impact earnings by around €1.4 billion (previously: €1.7 billion).

Automotive production higher year-on-year

According to preliminary figures, the global production of passenger cars and light commercial vehicles amounted to almost 22 million units in the second quarter of 2023, representing an increase of around 16 percent compared with the relatively weak prior-year quarter (Q2 2022: 19.0 million units).

Vehicle production in Europe grew to around 4.4 million units in the months of April, May and June 2023 (+15 percent). North America also recorded an increase of around 15 percent to around 4.1 million units. China recorded a substantial year-on-year rise of 20 percent to around 6.6 million units.