DUBLIN, Ireland — The global automotive sensors market is worth $19.2 billion and is expected to reach $44 billion by 2033 at a compound-annual-growth rate (CAGR) of 8.6%, according to a recently published report by Future Market Insights (FMI).

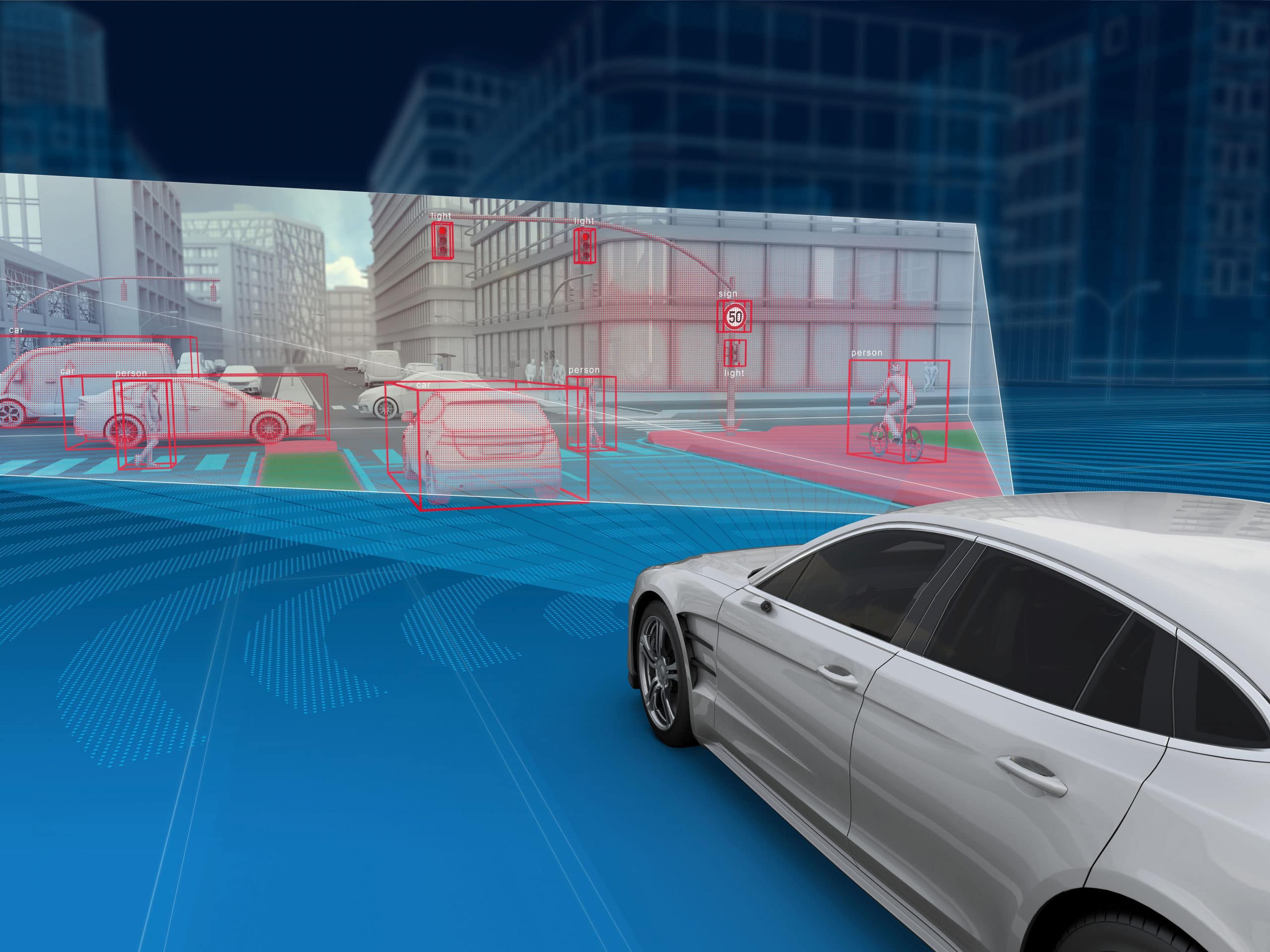

With the automotive vertical witnessing tremendous demand for electronic sensors, especially to position sense applications (like advanced driver-assistance systems, ADAS), the global automotive sensors market is expected to grow on an unstoppable note in the forecast period.

In addition, with a spike in the frequency of road accidents, the global automotive sensors market is slated to grow irrevocably in the forecast period.

These days, manufacturers are handsomely penalized if the cause of an accident is found to be a failure of the safety system. National Highway Traffic Safety Administration has established the FMVSS (Federal Motor Vehicle Safety Standard) No. 126 which makes it imperative for automakers to have ESC (electronic stability control) installed in passenger cars, buses, trucks, and multipurpose passenger vehicles.

Future Market Insights has etched these facets with future perspectives in its latest market study entitled “Autonomous Sensors Market.”

“With stern regulations being implemented by governments regarding fuel efficiency, the global automotive sensors market is bound to grow gracefully in the forecast period”, said an analyst from Future Market Insights.

Key Takeaways from the Automotive Sensors Market

- The Asia-Pacific is witnessing maximum turbulence in the automotive sensors market with China and Japan leading from the front. This is evident from the fact that the year 2019 saw Japan’s Ministry of Land, Infrastructure, Transport, and Tourism mandating the installation of automated emergency braking (AEB) in every new-fangled passenger vehicle by November 2021.

- North America holds the second-largest market share with the US seeing an ever-increasing demand for EVs.

- Europe is expected to grow in the automotive sensors market on the back of Germany.

Competitively Automotive Sensors

- Uni-automation is known for creating a spectrum of sensors for several parameters like wire wound potentiometers, joystick controllers, conductive plastic potentiometers, and likewise. The end-use applications include automotive, medical, locomotive, and likewise.

- Blickdeld comes across as one of the leading providers of LiDAR technology regarding autonomous vehicles. They make use of LiDAR for generating detailed three-dimensional images; thereby capturing full scenes with horizontal and vertical details. This resolution is adaptive, thereby adjusting to exclusive situations.

- Clairpixel does specialize in single-chip imaging solutions; thereby offering a broad range of CMOS image sensors for addressing sectors like mobile, medical, security, and automotive.

- Robert Bosch GmbH, in November 2021, came up with an advanced driver-assistance system (ADAS) for ‘city rail transportation’. In case of collision, it does warn the tram driver through the signal. If a driver gets late in intervening, the system goes ahead breaking the tram till it comes to a halt regarding the prevention of an impact or at least causing minimum damage.

- Infineon Technologies AG, in October 2021, did launch XENSIV TLE4972. This coreless current sensor makes use of Infineon’s proven Hall technology for stable and accurate current measurements.

- Continental AG, in July 2021, entered into a partnership with a LiDAR expert termed ‘AEye’ for integrating long-range LiDAR technology into a ‘full sensor stack solution’, thereby creating the very first full-stack automotive-grade system for Level 2+, which could go to Level 4 autonomous and automated driving applications. This solution, which is based on the LiDAR technology of An Eye, comes across as a notable part of sensor set-up pertaining to high-level automation systems.

- Vitesco Technologies, in June 2020, partnered with ROHM Semiconductor to use the latter’s technology in the electric vehicle high-power electronics.

- Robert-Bosch GmbH, in January 2020, turned out to be the very first company to come up with long-range LiDAR sensors, which are well suited for use in automobiles.